After the Storm: Effectively Subrogating Mother Nature

The picture you are seeing is my dock, torn from its pilings after Hurricane Ian. Was it the result of massive waves battering it for 48 hours straight or was it the result of poor design and craftsmanship. In today’s blog we are going to take a closer look at the various aspects of subrogating Mother Nature, including a great case study.

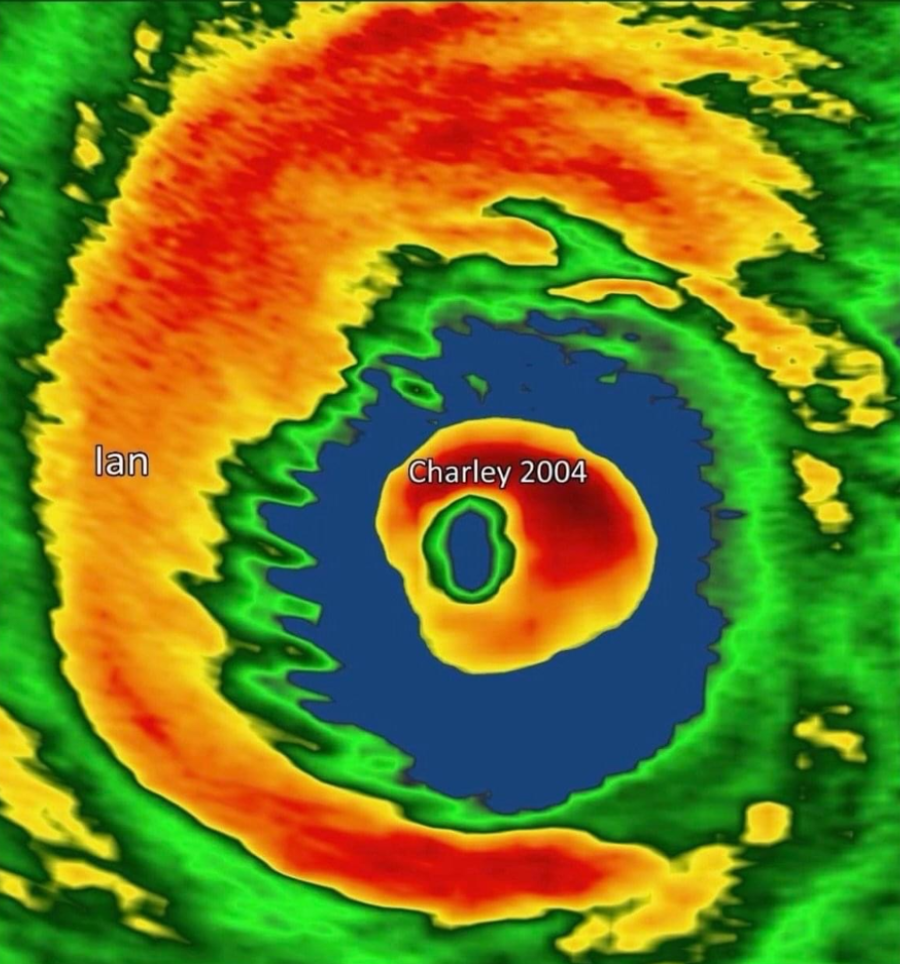

Hurricane Ian was one for the ages. I have probably been through thirty named storms over the years and this one was a once in a lifetime experience, and I wasn’t even close to where it made landfall. Ian hit with 153 mph sustained winds, 2 mph shy of a CAT 5, causing extensive devastation across the Florida peninsula. In my location on the east coast of the state, but in the path of the eyewall, the outer bands began arriving midafternoon on September 28th. The eye went over us for six hours the following day, followed by the trailing bands that wound down on September 30th.

To put the size in perspective, the storm caused damage from Marco Island to well north of Tampa on the west coast, and from Fort Pierce to Flagler Beach on the east coast, both four-hour drives. Most hurricanes that have hit Florida would have fit in the eye of Ian.

It was a jaw dropping size and in addition to winds Ian dropped record amounts of rain in Central Florida before exiting the east coast over Volusia and Brevard County as a CAT 2 storm. Of course, storm season didn’t end with Ian as we got hit by a less severe Nicole six weeks later. But with the ground already saturated and structures already weakened from Ian, more damage was just par for the course.

Here is where we begin the investigation into potential subrogation after storms, be they hurricanes, tornadoes, nor’easters or some other weather related phenomenon. While damage is often due to wind and rain, the reality is that there is a lot of shoddy construction. In the most basic example, you have the aforementioned dock. While the driving waves did separate the dock from the pilings, construction experts have said that the stringers were attached on the wrong side of the pilings. Had they been east of the pilings the driving waves would have pushed them, versus pulling, and not been able to loosen the lags. In addition, the hurricane clips used to attach the deck to the pilings were insufficient and had lags been properly installed through the hangars to the pilings the deck likely would have not come loose. This is just one simple example of how poor construction can result in potential subrogation.

Unfortunately for those with decks, docks and seawalls over the water, this is all excluded by policy. The result is that the affected homeowners will have to pursue contractors directly. But in many instances, there may be coverage. Improperly installed roofs, windows and doors could have failed. As adjusters continue their investigations there will likely be covered losses making it extremely important to dig into all facets of construction.

In some instances, it is even possible that property owners and/or contractors were aware of certain conditions from prior acts of God that previously resulted in catastrophic damage. This is why it takes a lot of digging to determine what is and is not recoverable.

Let’s take a look at a case study from an audit conducted by SecondLook, a leader in subrogation investigation and services. This particular case involved a commuter parking lot that was flooded during a storm. A significant number of cars were damaged. This would appear to be an act of God, right?

This is why digging deeper results in finding money that is often left on the table. In this case, the parking lot was adjacent to a large river. During the investigation it was determined that the parking lot had flooded on multiple prior occasions, all during a full moon at high tide. The owners were aware of this, and warnings should have been posted or the parking lot closed during such events.

But it doesn’t stop there. As the adjuster dug deeper it turns out that aerial imagery showed that the parking lot had grown year over year as owners brought in fill, encroaching on the river. Yet no permits were ever found, indicating that the parking lot expansion was occurring without oversight from local, state or federal officials.

In this particular case the SecondLook adjuster was able to present evidence to the carrier for the parking lot resulting in an amicable settlement. The subrogation money was collected for the SecondLook client and deductibles were returned to many very happy customers.

There is a reason that 15% of all claims are closed with a missed subrogation opportunity. Basic investigations, algorithms, AI and ML can all do a decent job on subrogation ID for less complex recovery opportunities. But as cases get more complex, it requires a lot of digging, knowledge and intuition to get to the right outcome. SecondLook’s SecondLook Technology takes things a step further by modeling over 600 years of collective claims experience to ID what others miss. To date, the company has recovered over a billion dollars for clients.

Before closing out and writing off those storm related claims, consider taking a SecondLook, utilizing a NO COST closed file audit. You never know what you will find in those claims.

Chris Tidball is an Executive Claims Consultant with SecondLook, a leading provider of subrogation services. His career has spanned more than thirty years, working in adjusting, leadership and consulting roles for multiple to insurers. He is the author of Re-Adjusted: Taking Your Claims Organization From Ordinary to Extraordinary, fictional thrillers Swoop & Squat and Deep State, and is the creator of the TV series The Adjuster. To learn more about how SecondLook can deliver missed revenue to you please contact ctidball@2ndlook.net or visit www.secondlook.net