The key message from the book “Who Moved My Cheese” by Dr. Spencer Johnson, is that things constantly change, so we must adapt. Yet in the world of subrogation, much remains the same with more than 15% of claims being closed with a missed subrogation opportunity at an annual cost to the industry of $15 billion dollars.

In this day of advanced algorithms, AI and machine learning, this just shouldn’t be the case. The reality is that all of the aforementioned are vitally important, but they only get you part of the way there. When you have complex recovery scenarios, PIP nuances, convoluted workers’ compensation laws and evolving case law, it often becomes to challenging to build accurate models.

When it comes to subrogation, the name of the game is identification and preservation. If you don’t ID the subrogation, and preserve necessary evidence, you are going to miss the recovery. It is a simple formula. Despite this, many opportunities do get missed, as our industry-leading subrogation experts see in routine closed file audits which led to the creation of SecondLook Technology that leverages not only technology, but over six hundred years of subrogation expertise.

For today, let’s look at one key strategy that significantly improves results when properly utilized: Comparative Negligence.

Data compiled by SecondLook, a leader in subrogation services, estimates that the recovery rate for collision claims across the industry is 22-28%, but could be as high as 37-40% if comparative negligence were properly identified and applied. This recovery gap is the variant opportunity for improvement that exists.

Aside from straightforward situations such as intersection, lane change, parking lot accidents and slip & falls, there are a myriad of opportunities where comparative fault would apply in virtually any coverage line. Concepts such as assumption of risk and last clear chance, phrases not heard since our adjuster boot camps, need to become part of the daily claim vernacular once again.

SecondLook estimates that in their closed file audits only about 3% of all carrier claims reviewed have a shared liability assessment. This is a much different outcome than what we see with juries, where it is estimated that more than 50% of cases adjudicated have liability apportioned between the parties.

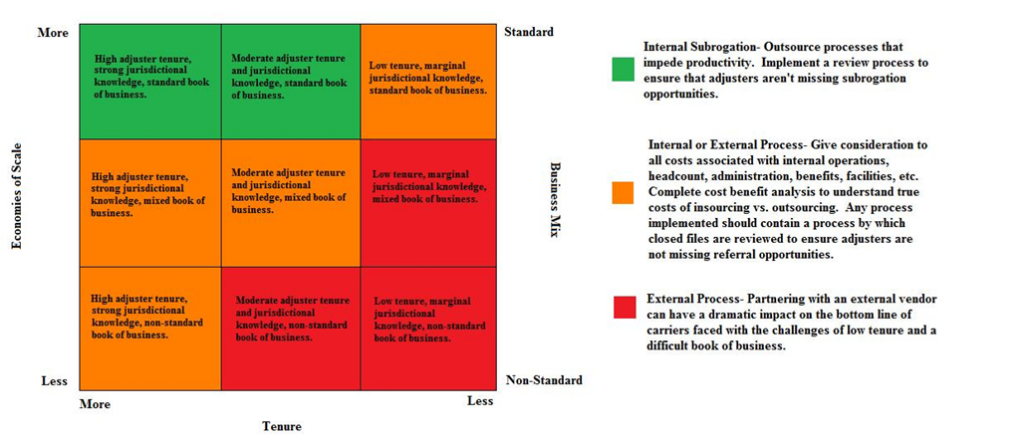

As the adjusting population retires, there is going to become an even bigger void in experience that will likely result in even more missed subrogation. This is further exacerbated by the outsourcing of first notice of loss (FNOL), often overseas. While FNOL can serve as a valuable training experience for future adjusters, the costs savings of outsourcing is what some carriers are more focused upon. When the accuracy of information and data collection becomes problematic, it has a direct and quantifiable impact on a carrier’s bottom line. When relying on subrogation models, the output is only as good as the data being collected.

Beyond FNOL, adjusters are often measured in terms of production versus the quality of their work, which results in critical items slipping through the cracks. A missed witness statement here, an overlooked piece of evidence there, and missing police reports and witness statements can all add up to billions of dollars in leakage across the industry.

A renewed focus on execution associated with effective and accurate investigations and outcomes will drive overall subrogation recognition, a key component to improving profitability. Recognizing subrogation as an area of opportunity and focusing on continuous process improvement by leveraging expertise in the industry is how we will define the most successful carriers in the coming years.

Chris Tidball is an executive claims consultant with SecondLook, an industry-leading subrogation firm with over 600 years of collective experience that has recovered over $1 billion for clients. His career spans over 30 years, including adjusting, management and executive roles with multiple top 10 P&C carriers. He is a frequent industry speaker and the author of multiple books.