As a big supporter of data analytics, and their use in the subrogation process, let me be the first to say that everyone should utilize them. But, you should not solely rely on them because they only get you 60-85% of the way there, depending on how good the modeling is.

The reason for this shortcoming is threefold. First, data scientists usually don’t have a claims background. Second, claims professionals usually don’t have a data science background. Third, there are a lot of claims that are simply too complex to build algorithms to identify.

I am in a unique position of seeing this from both the carrier and the vendor side. During my tenure as an executive with subrogation responsibilities for a large, global carrier, we had a great data science team. Our algorithms were outstanding, and we utilized top tier claims professionals to help build out the models. We still missed a lot of subrogation, which we learned after an engagement with SecondLook.

SecondLook provided keen insights into our process and helped us identify the best path forward. They became an invaluable partner who assisted us in achieving record amounts of recovery dollars.

From a vendor perspective, I see this on a daily basis, as we partner with insurers, self-insured’s and TPA’s, to help them find more money. In fact, we are so confident that money is being left on the table that we will do our closed file audits at no charge.

A question I get a lot is how can we find money when others missed it? This is a somewhat complex answer that will vary from client to client, but simply put there is an over-reliance on data that does a great job of identifying the low hanging fruit but misses a lot of more complex claims.

Like pretty much everyone in the industry, we also use algorithms to ID and score recovery opportunities, but unlike others we have also modeled over 600 years of collective claims experience into this process. By blending the people component with analytics, a more robust process was created which identifies a significant amount of subrogation that is otherwise missed.

As an example, SecondLook reviewed a sizeable volume of claims that were closed by the front-line claims adjuster and an external subrogation vendor. After our review of these claims we recovered over $2 million dollars that both had missed.

What our process creates is a plug and play solution that is configurable to any organization. In some instances we find clients that are doing a remarkable job on collision claims but are missing the mark to the tune of millions of dollars on PIP and Medpay. In other situations, such as workers’ compensation there is often a rush to closure and future credits are left on the table. In the world of healthcare, we see tremendous opportunities to identify potential liability claims that are currently being missed.

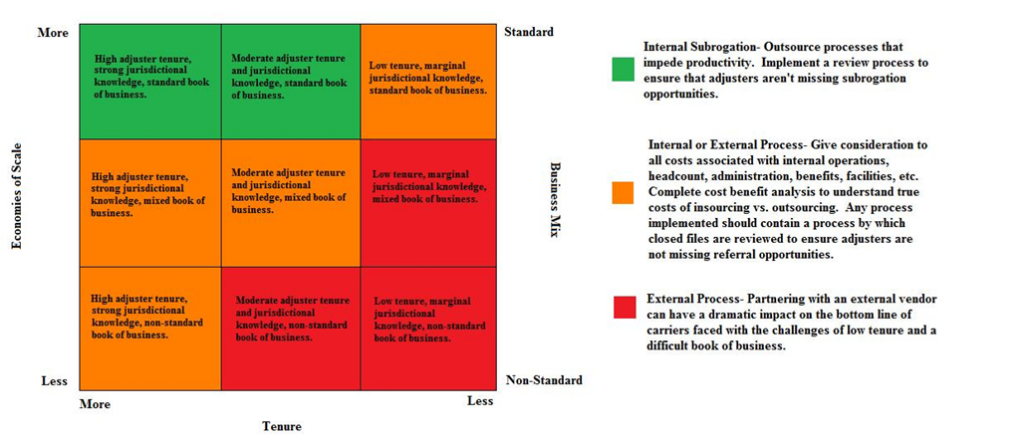

Finding and recovering on missed subrogation provides a tremendous lift to organizations and can provide valuable insight into why these claims are being missed in the first place. While there are a myriad of reasons why, it often comes down to training and time. Adjusters, especially young adjusters, often don’t fully understand complex subrogation scenarios and concepts. As carriers have centralized claims organizations and pulled boots off the street, the local jurisdictional knowledge that adjusters had in years past has declined. Adjusters are also under a tremendous amount of pressure to get claims closed, and as I learned as a claims leader, anything but 100% clear liability subrogation is often pushed to closure to achieve a desired disposition outcome.

Chris Tidball is an Executive Claims Consultant with SecondLook, a leading provider of subrogation services. He spent more than twenty years with multiple leading insurers as an adjuster, manager and executive. Chris is the author of Re-Adjusted: 20 Essential Rules To Take Your Claims Organization From Ordinary to Extraordinary, multiple fictional claims thrillers and the screenplay for the television series The Adjuster. He can be reached at ctidball@2ndlook.net